The fact that the SBA created and defined the role of an independent disaster agent that can be utilized for obtaining disaster assistance is a little-known fact. Business owners in declared disaster areas can retain the assistance of an independent agent or agency to represent them in obtaining working capital loans in amounts up to two million dollars with no payments or interest accrual for the first twelve months. After the deferment period, the loan can be amortized over thirty years at a fixed four percent interest rate, simple interest, and no prepayment penalty.

The fact that the SBA created and defined the role of an independent disaster agent that can be utilized for obtaining disaster assistance is a little-known fact. Business owners in declared disaster areas can retain the assistance of an independent agent or agency to represent them in obtaining working capital loans in amounts up to two million dollars with no payments or interest accrual for the first twelve months. After the deferment period, the loan can be amortized over thirty years at a fixed four percent interest rate, simple interest, and no prepayment penalty.

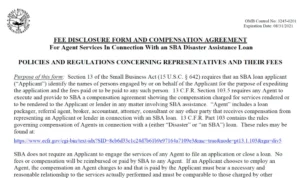

If your business is in a disaster area and can not or soon will not be able to pay the normal operating expenses your business may be eligible for this disaster loan referred to as the Economic Injury Disaster Loan. When such financing is critical to you and your employees’ survival, retaining professional assistance may be your best decision. Many mistakes can be made when applying for this assistance; timing is everything. The SBA explains that hiring a professional agency to represent you expedites the loan processing. This is accomplished with experience, knowledge, and a desire to assist a disaster victim in obtaining assistance as quickly as possible.

References are critical and available from business owners we have helped in many previous disasters. Contact us for a live discussion of your situation.